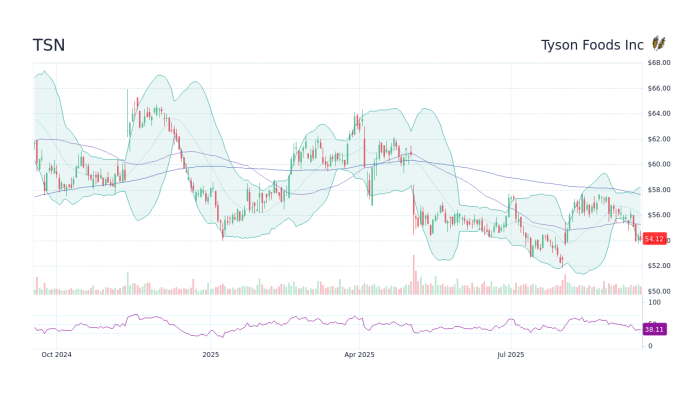

Kicking off with TSN Stock Forecast 2025: Should You Buy or Hold Tyson Foods?, this opening paragraph is designed to captivate and engage the readers, providing an overview of what to expect in the discussion ahead.

Exploring the world of TSN stock forecast for 2025 and the considerations surrounding investing in Tyson Foods will shed light on the potential opportunities and risks for investors.

Introduction to TSN Stock Forecast 2025

TSN stock refers to Tyson Foods Inc., a major player in the food processing industry. With a strong presence and reputation in the market, TSN stock holds significance for investors looking to diversify their portfolios.

Forecasting plays a crucial role in helping investors make informed decisions about buying, holding, or selling stocks. By analyzing past trends, current market conditions, and various economic factors, forecasts provide valuable insights into the potential future performance of a stock.

The Influence of Stock Forecasts on Investment Decisions

- Stock forecasts help investors assess the potential risks and rewards associated with a particular stock, guiding them in making strategic investment choices.

- By studying forecasts, investors can gain a better understanding of market trends, allowing them to anticipate changes and adjust their investment strategies accordingly.

- Accurate stock forecasts can instill confidence in investors, providing them with a sense of security and helping them navigate the volatile nature of the stock market.

- On the contrary, inaccurate forecasts can lead to poor investment decisions, resulting in financial losses for investors who rely heavily on such predictions.

Tyson Foods Company Overview

Tyson Foods, founded in 1935 by John W. Tyson, is a leading American multinational corporation in the food industry. Initially starting as a small family-owned business, Tyson Foods has grown to become one of the largest meat processing companies globally.

Key Products and Services

- Tyson Foods primarily specializes in the production and distribution of chicken, beef, and pork products.

- The company offers a wide range of branded and unbranded food products, including fresh meats, frozen foods, and prepared foods.

- Additionally, Tyson Foods provides value-added products such as deli meats, sausages, and bacon to cater to diverse consumer preferences.

Current Market Position

Tyson Foods holds a strong market position in the food industry, consistently ranking among the top meat processing companies globally. The company's commitment to quality, innovation, and sustainability has helped it maintain a competitive edge in the market.

Factors Influencing TSN Stock Forecast 2025

As we dive into the factors that could impact Tyson Foods' stock forecast for 2025, it's essential to consider the industry trends, global events, and recent developments within the company.

Impact of Industry Trends on Tyson Foods' Stock Forecast

- The rise in demand for plant-based protein alternatives could pose a threat to Tyson Foods' traditional meat products, affecting sales and profitability.

- Consumer preferences shifting towards healthier and sustainable food options may require Tyson Foods to adapt its product offerings to stay competitive in the market.

- Changes in government regulations related to food safety, labeling, and environmental impact could impact Tyson Foods' operations and financial performance.

Global Events and TSN Stock Performance

- Trade disputes or tariffs imposed on agricultural products could affect Tyson Foods' exports and international market presence, impacting revenue and profitability.

- Global economic conditions, such as inflation rates, currency fluctuations, or geopolitical tensions, may influence consumer purchasing power and ultimately Tyson Foods' financial performance.

Recent Developments within Tyson Foods

- Tyson Foods' investments in technology and innovation, such as automation in production facilities or new product development, could enhance operational efficiency and drive growth in the long term.

- The company's sustainability initiatives, including efforts to reduce carbon emissions and waste, may resonate with environmentally-conscious consumers and positively impact brand reputation.

- Partnerships or acquisitions made by Tyson Foods to expand its portfolio or enter new markets could result in increased market share and revenue diversification.

Should You Buy or Hold TSN Stock in 2025?

Investors considering whether to buy or hold TSN stock in 2025 should carefully weigh the advantages and disadvantages before making a decision. It's crucial to understand the potential risks associated with holding TSN stock and to have a clear strategy in place for evaluating the stock's performance.

Advantages and Disadvantages of Buying TSN Stock

- Advantages:

- Strong Market Position: Tyson Foods is a leading player in the food industry, with a diverse portfolio of products.

- Steady Revenue Growth: The company has shown consistent revenue growth over the years, indicating financial stability.

- Dividend Payments: Investors may benefit from regular dividend payments, providing a source of income.

- Disadvantages:

- Market Volatility: The stock market can be unpredictable, leading to fluctuations in TSN stock prices.

- Regulatory Risks: Changes in regulations or policies could impact Tyson Foods' operations and financial performance.

- Competition: The food industry is highly competitive, which could pose challenges for Tyson Foods in maintaining its market position.

Potential Risks Associated with Holding TSN Stock

- Market Risks: External factors such as economic conditions, geopolitical events, and market trends can affect TSN stock prices.

- Company-Specific Risks: Tyson Foods may face risks related to supply chain disruptions, product recalls, or lawsuits, which could impact its stock performance.

- Industry Challenges: Changes in consumer preferences, health trends, or raw material costs could pose challenges for Tyson Foods' profitability.

Strategies for Evaluating TSN Stock in 2025

- Financial Analysis: Conduct a thorough analysis of Tyson Foods' financial statements, including revenue, profit margins, and debt levels.

- Market Research: Stay informed about industry trends, competitor performance, and overall market conditions to assess TSN stock's potential growth.

- Risk Management: Diversify your investment portfolio to mitigate risks associated with holding TSN stock and consider setting stop-loss orders to protect your investment.

Last Word

Wrapping up the discussion on TSN Stock Forecast 2025: Should You Buy or Hold Tyson Foods?, it's evident that making informed decisions based on forecasts and market analysis is crucial for investors looking to navigate the stock landscape.

Questions and Answers

What factors should investors consider when evaluating TSN stock for 2025?

Investors should consider industry trends, global events, and recent developments within Tyson Foods that may impact the stock forecast.

What are the potential risks associated with holding TSN stock in 2025?

Potential risks include market volatility, changes in consumer preferences, and competitive pressures within the food industry.

How can investors decide whether to buy, hold, or sell TSN stock in 2025?

Investors can evaluate the advantages and disadvantages of buying TSN stock, assess the potential risks, and develop strategies based on their financial goals and risk tolerance.