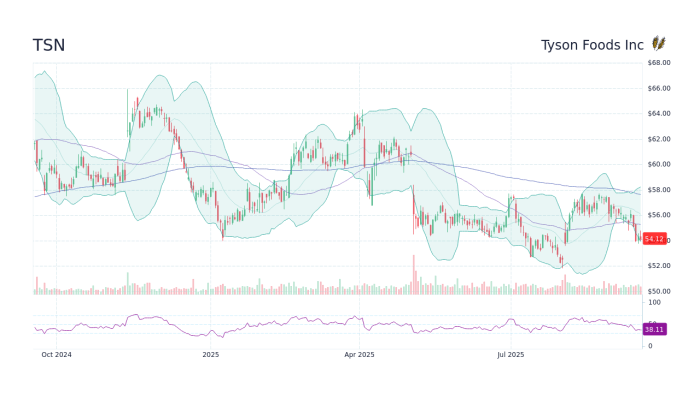

Beginning with TSN Stock Analysis: Is Tyson Foods Still a Safe Investment in 2025?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Tyson Foods, a prominent player in the food industry, has a rich history and a strong set of values that have shaped its mission over the years. As we delve into the financial performance, market trends, sustainability efforts, risk assessment, and future outlook of Tyson Foods, the question of whether it remains a safe investment in 2025 becomes increasingly relevant and intriguing.

Introduction to Tyson Foods

Tyson Foods is a multinational corporation and one of the largest food companies in the world. Founded in 1935 by John W. Tyson, the company has a long history of providing quality meat products to consumers worldwide.

History and Background of Tyson Foods

- Founded in 1935 in Arkansas, USA

- Initially started as a small family-owned chicken business

- Rapid expansion and diversification into other meat products over the years

Mission and Values of Tyson Foods

- Commitment to sustainable food production

- Focus on animal welfare and ethical practices

- Providing safe, high-quality products to consumers

Current Standing in the Food Industry

- One of the largest meat producers globally

- Strong presence in the poultry, beef, and pork markets

- Ongoing efforts to adapt to changing consumer preferences and market trends

Financial Performance Analysis

When analyzing Tyson Foods' financial performance in recent years, several key metrics come into play, including revenue, profit margins, and earnings growth. It is essential to compare these figures with those of industry peers and take into account analysts' forecasts for the company's financial future.

Revenue Growth

Tyson Foods has shown steady revenue growth over the past few years, driven by strong demand for its products in the market. The company's diversified product portfolio has allowed it to capture a significant share of the market, resulting in a positive revenue trend.

Profit Margins

Profit margins are another crucial aspect of Tyson Foods' financial performance. The company has managed to maintain healthy profit margins despite facing challenges in the industry, such as fluctuating commodity prices and changing consumer preferences. This stability in profit margins reflects the company's efficient cost management and strategic pricing strategies.

Earnings Growth

In terms of earnings growth, Tyson Foods has demonstrated resilience and adaptability in navigating market uncertainties. By focusing on innovation and operational efficiency, the company has been able to sustain consistent earnings growth, providing value to its shareholders.

Comparison with Industry Peers

When comparing Tyson Foods' financial performance with industry peers, the company stands out for its robust financial position and market leadership. Despite facing competition from other players in the industry, Tyson Foods has maintained a competitive edge through its strong brand presence and customer loyalty.

Analysts' Forecasts

Analysts' forecasts for Tyson Foods' financial future are optimistic, projecting continued growth and profitability for the company. With strategic investments in technology and product innovation, Tyson Foods is well-positioned to capitalize on emerging market trends and sustain its success in the years to come.

Market Trends and Challenges

As Tyson Foods navigates the ever-evolving landscape of the food industry, it encounters various market trends, challenges, and regulatory factors that shape its operations and growth opportunities.

Market Trends Impacting Tyson Foods

- The rise of plant-based alternatives: With the increasing consumer demand for plant-based products, Tyson Foods faces competition from companies offering alternative protein sources.

- Focus on sustainability: Consumers are becoming more conscious of sustainability practices, prompting Tyson Foods to adapt its operations to meet these expectations.

- Technological advancements: Embracing technology in food production and distribution is crucial for Tyson Foods to stay competitive and efficient in the market.

Challenges Faced by Tyson Foods

- Supply chain disruptions: Tyson Foods must navigate supply chain challenges, including transportation issues and fluctuating commodity prices.

- Changing consumer preferences: Keeping up with shifting consumer demands and preferences requires Tyson Foods to innovate and diversify its product offerings.

- Regulatory scrutiny: Compliance with food safety regulations, labeling requirements, and environmental standards poses challenges for Tyson Foods in maintaining operational efficiency.

Opportunities for Growth in the Food Industry

- Expansion into international markets: Tyson Foods has the opportunity to explore new markets and expand its global footprint to drive growth and increase market share.

- Diversification of product portfolio: Introducing new product lines and catering to niche markets can help Tyson Foods capture a broader consumer base and drive revenue growth.

- Investment in research and development: Innovation in food technology and sustainable practices can position Tyson Foods as a leader in the industry and attract environmentally conscious consumers.

Regulatory Factors Affecting Tyson Foods' Operations

- Food safety regulations: Compliance with strict food safety standards is essential for Tyson Foods to maintain consumer trust and uphold its reputation in the market.

- Labeling requirements: Ensuring accurate and transparent labeling of products is crucial for Tyson Foods to meet regulatory standards and provide consumers with essential information.

- Environmental regulations: Adhering to environmental regulations and sustainability practices is imperative for Tyson Foods to minimize its ecological footprint and contribute to a greener future.

Sustainability and Corporate Social Responsibility

When it comes to sustainability and corporate social responsibility, Tyson Foods has been actively involved in various initiatives to ensure they are operating in a socially and environmentally responsible manner.

Tyson Foods' Sustainability Initiatives

- Tyson Foods has committed to reducing greenhouse gas emissions by 30% by 2030 as part of their sustainability goals.

- The company is also working towards improving water stewardship and responsible sourcing of raw materials.

- They have implemented animal welfare programs to ensure the humane treatment of animals throughout their supply chain.

Corporate Social Responsibility Efforts

- Tyson Foods has been actively involved in community outreach programs, supporting local communities where they operate.

- They have also prioritized diversity and inclusion within their workforce, aiming to create a more inclusive workplace environment.

- The company has focused on food security initiatives, working to combat hunger and food insecurity in the areas they serve.

Impact of Sustainability Practices

The sustainability practices implemented by Tyson Foods have not only helped reduce their environmental footprint but have also positively impacted their bottom line. By improving efficiency and reducing waste, the company has seen cost savings and improved overall profitability.

Comparison with Competitors

Compared to its competitors, Tyson Foods' sustainability performance stands out in terms of clear goals and measurable targets. The company's transparency in reporting and commitment to sustainable practices give them a competitive edge in the market.

Risk Assessment and Mitigation Strategies

Investing in Tyson Foods comes with its own set of risks, which need to be carefully evaluated and addressed to ensure a safe investment. Tyson Foods has implemented various strategies to mitigate these risks and enhance the safety of the investment.

Evaluation of Risks Associated with Investing in Tyson Foods

When considering investing in Tyson Foods, it's important to be aware of the risks involved. Some key risks include fluctuations in commodity prices, regulatory challenges in the food industry, and potential reputational damage due to food safety issues.

Strategies Employed by Tyson Foods to Mitigate Risks

Tyson Foods has implemented several strategies to mitigate risks and safeguard its investments. This includes diversifying its product portfolio, investing in technology to enhance food safety measures, and maintaining strong relationships with suppliers and distributors.

Assessment of External Factors Influencing Investment Safety in Tyson Foods

External factors such as changes in consumer preferences, global economic conditions, and geopolitical events can influence the safety of investments in Tyson Foods. It's crucial to monitor these factors closely to make informed investment decisions.

Comparison of Risk Factors between Tyson Foods and Other Investment Options

When comparing risk factors between Tyson Foods and other investment options, it's important to consider the specific risks associated with the food industry, as well as the overall market conditions. Conducting a thorough risk assessment can help investors determine the best investment strategy based on their risk tolerance and financial goals.

Future Outlook and Investment Recommendation

As we look ahead to the future of Tyson Foods in 2025 and beyond, there are several potential growth opportunities that could shape the company's performance. With the increasing demand for protein products globally, Tyson Foods is well-positioned to capitalize on this trend and expand its market presence.

Potential Growth Opportunities

- Expansion into new markets: Tyson Foods can explore new markets and regions to diversify its revenue streams and reach a wider customer base.

- Innovation in product development: Investing in research and development to create innovative and sustainable products can help Tyson Foods stay competitive in the market.

- E-commerce and digitalization: Embracing e-commerce platforms and digital technologies can enhance Tyson Foods' distribution channels and improve customer engagement.

Investment Recommendation

- Based on the analysis of Tyson Foods' financial performance and market trends, it is recommended to consider investing in the company for long-term growth potential.

- The company's strong focus on sustainability and corporate social responsibility further enhances its attractiveness to investors looking for ethical and environmentally conscious investment opportunities.

Factors to Consider

- Market competition: Analyzing the competitive landscape and market dynamics can help investors assess the risks and opportunities associated with investing in Tyson Foods.

- Regulatory environment: Monitoring changes in regulations related to food safety, labeling, and environmental practices is crucial for making informed investment decisions.

- Global economic conditions: Understanding how macroeconomic factors can impact Tyson Foods' operations and financial performance is essential for evaluating investment risks.

Conclusion

In conclusion, considering the growth opportunities, strong performance, and commitment to sustainability, Tyson Foods appears to be a safe investment in 2025 for investors seeking long-term value and growth potential.

Final Review

In conclusion, the analysis of Tyson Foods' current standing, along with the exploration of its potential growth opportunities and risk factors, paints a comprehensive picture for investors. Whether Tyson Foods is a safe investment in 2025 hinges on various factors discussed in this detailed evaluation.

As the food industry evolves, staying informed and proactive will be key for making sound investment decisions.

Questions and Answers

Is Tyson Foods a reliable investment option for 2025?

Based on the analysis provided, Tyson Foods shows promise for growth and sustainability, making it a potentially safe investment choice in 2025. However, investors should always conduct their own research and consider market conditions before making any investment decisions.

What sets Tyson Foods apart from its competitors in terms of sustainability?

Tyson Foods has implemented robust sustainability initiatives that not only benefit the environment but also positively impact its bottom line. The company's relentless focus on sustainability gives it a competitive edge over its peers.

Are there any regulatory challenges that could affect Tyson Foods' operations?

Yes, Tyson Foods faces regulatory factors that can impact its operations, such as changing food safety regulations and environmental policies. Staying compliant and adapting to evolving regulations are crucial for the company's long-term success.