Delving into Sofi Consolidation: How to Combine Student Loans Easily, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Providing a detailed explanation of Sofi Consolidation and its benefits, this guide aims to simplify the process of combining student loans effortlessly.

Overview of Sofi Consolidation

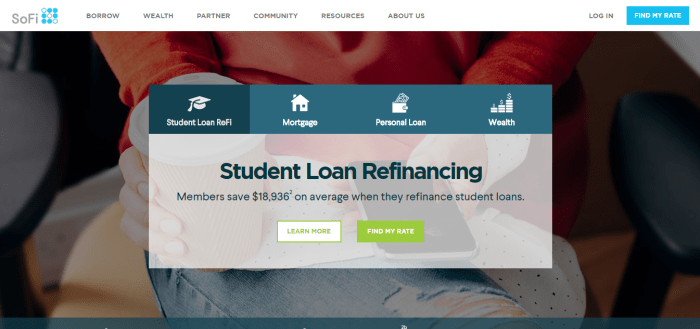

Sofi Consolidation is a service provided by SoFi, a leading online personal finance company, that allows borrowers to combine multiple student loans into a single, more manageable loan with a potentially lower interest rate. This process simplifies the repayment process by consolidating various loans into one, making it easier to keep track of payments and potentially save money over time.

Benefits of Sofi Consolidation

- Lower Interest Rates: Sofi may offer lower interest rates compared to the individual rates on existing loans, potentially saving money over the life of the loan.

- Single Monthly Payment: Instead of juggling multiple loan payments, borrowers only need to make one monthly payment, streamlining the repayment process.

- Flexible Repayment Options: Sofi provides various repayment options, including income-driven plans, which can be beneficial for borrowers facing financial challenges.

- No Fees: Sofi does not charge application or origination fees for loan consolidation, making it a cost-effective option for borrowers.

Eligibility Criteria for Sofi Consolidation

- Credit Score: SoFi typically requires a minimum credit score for eligibility, often in the good to excellent range.

- Income: Borrowers need to demonstrate a stable income to show the ability to repay the consolidated loan.

- Educational Background: Sofi Consolidation is available for both undergraduate and graduate student loans, but specific requirements may vary.

- Loan Types: SoFi may have restrictions on the types of loans eligible for consolidation, so it's essential to check if your loans qualify.

Steps to Combine Student Loans with Sofi

When it comes to combining student loans with Sofi, the process is relatively straightforward and can help simplify your repayment strategy. Below are the step-by-step instructions to consolidate your student loans with Sofi.

1. Check Eligibility

Before beginning the consolidation process with Sofi, ensure that you meet the eligibility criteria set by the company. This may include having a minimum credit score, a certain amount of outstanding student loan debt, and being a U.S. citizen or permanent resident.

2. Gather Necessary Documents

To consolidate your student loans with Sofi, you will need to provide certain documents such as proof of income, identification documents, and details of your existing student loans. Make sure to have these documents ready to streamline the consolidation process.

3. Apply for Sofi Consolidation

Once you have checked your eligibility and gathered the required documents, you can start the application process for student loan consolidation with Sofi. This can typically be done online through their website or by contacting their customer service team.

4. Review and Accept Terms

After submitting your application, Sofi will review your information and present you with the terms of the consolidation loan. Take the time to review these terms carefully, including the interest rate, repayment period, and any fees associated with the consolidation.

5. Finalize the Consolidation

If you are satisfied with the terms offered by Sofi, you can proceed to finalize the consolidation of your student loans. This may involve signing a new loan agreement and providing any additional information requested by Sofi to complete the process

Comparison with Other Loan Consolidation Options

When comparing the consolidation process with Sofi to other loan consolidation options, Sofi stands out for its user-friendly online platform, competitive interest rates, and flexible repayment terms. Additionally, Sofi offers personalized customer support to guide you through the consolidation process, making it a convenient choice for borrowers looking to simplify their student loan repayments.

Interest Rates and Repayment Options

When it comes to consolidating student loans with Sofi, understanding the interest rates and repayment options is crucial in managing your finances effectively.

Interest Rates for Consolidated Loans

Interest rates for consolidated loans with Sofi are determined based on various factors such as your credit score, income, and the type of loan being consolidated. Generally, lower interest rates are offered to borrowers with a strong credit history and stable income.

Repayment Options

When consolidating student loans through Sofi, borrowers have different repayment options to choose from to suit their financial situation. Some common repayment options include:

- Standard Repayment Plan: Fixed monthly payments over a set period of time.

- Graduated Repayment Plan: Payments start low and increase over time.

- Income-Driven Repayment Plans: Monthly payments based on income and family size.

It's important to consider the pros and cons of each repayment option to determine which one aligns best with your financial goals and capabilities.

Impact of Repayment Options

The choice of repayment option can significantly impact the overall loan repayment amount and duration. For example, opting for an Income-Driven Repayment Plan may result in lower monthly payments but potentially higher total interest paid over the life of the loan.

On the other hand, a Standard Repayment Plan may lead to higher monthly payments but lower overall interest costs.

Managing Multiple Loans with Sofi

When it comes to managing multiple loans, Sofi offers a streamlined solution through consolidation, making it easier for borrowers to keep track of their debt and payments.

Consolidation Tools and Resources

Sofi provides borrowers with a user-friendly online platform where they can view all their consolidated loans in one place. This centralizes the information and allows for better organization and tracking of payments.

- Access to a dashboard that displays all loan details, including balances, interest rates, and repayment terms.

- Option to set up automatic payments to ensure timely and hassle-free repayments.

- Tools for calculating potential savings and comparing different repayment options.

Tips for Effective Management

To effectively manage and track consolidated loans with Sofi, borrowers can follow these tips:

- Regularly review loan statements and payment schedules to stay on top of deadlines.

- Utilize budgeting tools to manage cash flow and allocate funds for loan payments.

- Consider refinancing options if better terms or rates become available to optimize savings.

End of Discussion

Concluding our discussion on Sofi Consolidation: How to Combine Student Loans Easily, we have explored the ins and outs of this financial tool, empowering borrowers to make informed decisions about their student loans.

Q&A

What are the eligibility criteria for Sofi Consolidation?

To qualify for Sofi Consolidation, borrowers typically need a good credit score and a steady income. Specific requirements may vary, so it's best to check with Sofi directly.

How does interest rate determination work for consolidated loans with Sofi?

Interest rates for consolidated loans with Sofi are generally based on the borrower's creditworthiness and market conditions. It's essential to review current rates and terms with Sofi for accurate information.

What tools does Sofi provide to help borrowers manage multiple loans?

Sofi offers online account management tools, repayment calculators, and personalized support to assist borrowers in effectively managing their consolidated loans.