Delving into the realm of Mezzanine Debt Explained: How Hybrid Financing Works for Businesses sets the stage for a comprehensive exploration of this intricate financial strategy. Brace yourself for a journey filled with enlightening revelations and practical insights.

Exploring the nuances of mezzanine debt and its application in the business landscape will shed light on the dynamic interplay between risk and reward in the realm of corporate finance.

What is Mezzanine Debt?

Mezzanine debt is a form of hybrid financing that combines elements of both debt and equity. It is typically used by businesses to raise capital for various purposes, such as expansion, acquisitions, or restructuring.

How Mezzanine Debt Differs from Traditional Bank Loans

Mezzanine debt differs from traditional bank loans in several key ways. While bank loans are secured by specific assets of the business, mezzanine debt is unsecured and is backed only by the company's cash flow and assets. Additionally, mezzanine debt often has a higher interest rate than bank loans due to the increased risk for lenders.

Unlike bank loans, mezzanine debt may also include equity instruments, such as warrants or options, which provide lenders with the opportunity to convert their debt into ownership stakes in the company.

Examples of Situations where Mezzanine Debt is Beneficial for Businesses

- 1. Growth Initiatives: Mezzanine debt can be used to finance growth initiatives, such as expanding into new markets or launching new products, without diluting existing ownership.

- 2. Leveraged Buyouts: Mezzanine debt is commonly used in leveraged buyouts to bridge the gap between senior debt and equity financing, allowing buyers to acquire a company with a lower equity investment.

- 3. Recapitalizations: Mezzanine debt can be used in recapitalizations to provide liquidity to existing shareholders or to fund a dividend recapitalization, allowing owners to monetize a portion of their investment.

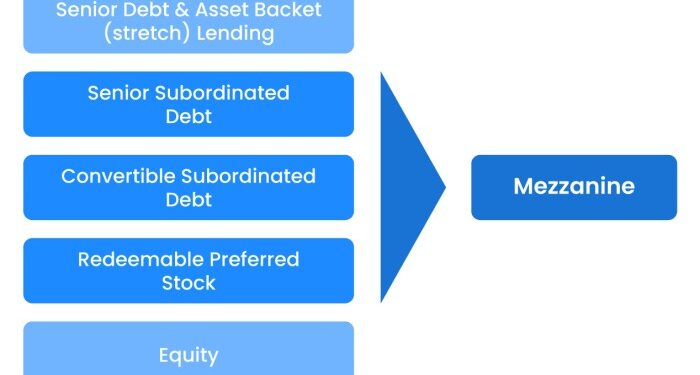

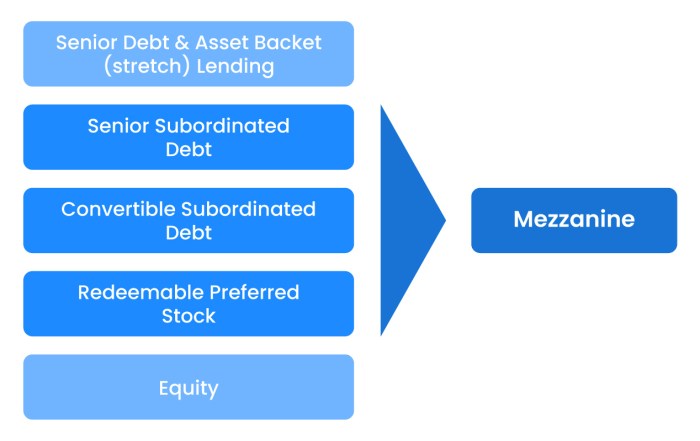

Structure of Mezzanine Debt

Mezzanine debt is a unique form of financing that combines elements of debt and equity. It typically has a higher interest rate than traditional senior debt due to its subordinated position in the capital structure.

Typical Terms and Structure

Mezzanine debt often comes in the form of unsecured loans with flexible repayment terms. It may include features such as payment-in-kind (PIK) interest, which allows the borrower to pay interest with additional debt rather than cash. Additionally, mezzanine debt can sometimes be convertible into equity if certain conditions are met.

Ranking in Capital Structure

Mezzanine debt is considered junior to senior debt but senior to equity in the capital structure. This means that in the event of bankruptcy or liquidation, mezzanine debt holders have a higher claim on assets compared to equity holders but are paid after senior debt holders.

Risks Compared to Other Financing

While mezzanine debt offers the advantage of providing additional capital without diluting ownership, it comes with higher risks. The higher interest rates and subordinated position increase the cost of capital and the potential for financial distress if the business struggles to meet its obligations.

Compared to senior debt, mezzanine debt carries a higher risk of default and may lead to loss of control if the loan is converted into equity.

Advantages of Mezzanine Debt

Mezzanine debt offers several advantages for businesses looking to secure additional funding for growth and expansion. This hybrid financing option can provide flexibility and support to companies in various stages of development.

Supports Growth and Expansion

Mezzanine debt can be a valuable tool for businesses seeking to expand their operations, enter new markets, or launch new products. By providing access to additional capital without diluting ownership, companies can pursue growth opportunities more aggressively.

- Mezzanine debt allows businesses to leverage their existing assets and cash flow to secure financing for expansion projects.

- It can be used to fund acquisitions, buyouts, or capital expenditures that contribute to the company's overall growth strategy.

Flexible Repayment Terms

One of the key advantages of mezzanine debt is its flexibility in terms of repayment. Unlike traditional bank loans, mezzanine debt often comes with more lenient repayment terms and may include options such as payment-in-kind (PIK) interest or balloon payments.

- Businesses can structure mezzanine debt to align with their cash flow and revenue projections, making it easier to manage debt service obligations.

- Flexible repayment terms can help companies navigate periods of fluctuating cash flow or unexpected expenses without defaulting on their obligations.

Success Stories

Several successful businesses have effectively utilized mezzanine debt to fuel their growth and achieve their strategic objectives. One notable example is XYZ Company, which used mezzanine financing to fund a major acquisition that significantly expanded its market presence.

"Mezzanine debt allowed us to pursue an acquisition that transformed our business and positioned us for long-term success," said the CEO of XYZ Company.

Another success story is ABC Corporation, which utilized mezzanine debt to launch a new product line that became a key driver of revenue growth for the company.

"Mezzanine financing provided the capital we needed to innovate and diversify our product offerings, leading to substantial business growth," said the CFO of ABC Corporation.

Application Process

When applying for mezzanine debt, businesses need to go through a structured process to secure the financing they need to fuel growth and expansion. This process involves meeting certain criteria and negotiating favorable terms to ensure a successful outcome.

Qualifying Criteria for Mezzanine Financing

- Strong Financial Performance: Businesses need to demonstrate a track record of strong financial performance to qualify for mezzanine financing. Lenders will assess factors such as revenue growth, profitability, and cash flow.

- Growth Potential: Lenders look for businesses with significant growth potential to ensure that the investment will yield returns. Companies with a clear growth strategy and market opportunity are more likely to qualify.

- Equity Contribution: Businesses may be required to make an equity contribution to secure mezzanine debt. This demonstrates commitment and reduces the lender's risk.

- Management Team: Lenders also evaluate the quality and experience of the management team. A strong and capable leadership team increases the likelihood of approval.

Negotiating Favorable Terms

- Interest Rates: Businesses can negotiate the interest rates on mezzanine debt to ensure they are competitive and aligned with the company's financial goals.

- Flexibility: Negotiating for flexibility in repayment terms can help businesses manage cash flow effectively and avoid financial strain.

- Covenants: Businesses should carefully review and negotiate any covenants attached to the mezzanine debt to ensure they are reasonable and achievable.

- Exit Strategy: Discussing the exit strategy with the lender can help businesses plan for the future and ensure a smooth transition when the debt is due for repayment.

Last Point

In conclusion, the intricate dance between risk and reward, growth and stability, in the realm of mezzanine debt unveils a compelling narrative for businesses seeking innovative financing solutions. With a deeper understanding of how hybrid financing works, businesses can navigate the complex financial landscape with confidence and strategic foresight.

Quick FAQs

What sets mezzanine debt apart from traditional bank loans?

Mezzanine debt typically combines elements of debt and equity, offering businesses a flexible financing option with higher potential returns compared to traditional bank loans.

How can businesses qualify for mezzanine financing?

Businesses usually need to demonstrate a strong track record, stable cash flows, and growth potential to qualify for mezzanine financing.

What advantages does mezzanine debt offer for businesses?

Mezzanine debt provides businesses with access to capital without diluting ownership, allowing for growth and expansion opportunities while maintaining control.