Kicking off with JEPI Stock vs SCHD: Which Dividend ETF Performs Better?, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Providing a brief overview of JEPI Stock and SCHD along with the significance of dividend ETFs in investment portfolios.

Introduction

JEPI Stock and SCHD are two popular dividend ETFs that investors often consider for their portfolios. JEPI Stock is an exchange-traded fund that focuses on providing exposure to high-quality, dividend-paying U.S. companies, while SCHD tracks the performance of U.S. large-cap dividend-paying stocks.

Both ETFs offer investors a way to potentially generate income through dividends while also benefiting from potential capital appreciation.Dividend ETFs are an essential component of many investment portfolios, especially for investors seeking a steady stream of income. These ETFs typically consist of a diversified basket of dividend-paying stocks, providing investors with exposure to companies that have a history of distributing a portion of their profits to shareholders in the form of dividends.

By investing in dividend ETFs, investors can potentially benefit from regular income payments and the potential for long-term growth.

JEPI Stock Overview

JEPI Stock is an exchange-traded fund (ETF) that focuses on dividend-paying stocks, specifically targeting companies with a history of consistent dividend growth. This ETF aims to provide investors with a steady stream of income through dividend payments while also offering the potential for capital appreciation over time.

Key Features of JEPI Stock

- JEPI Stock is actively managed, which means that a team of experts makes decisions regarding the selection and weighting of the stocks in the fund. This active management approach allows for more flexibility in responding to market conditions and trends.

- The ETF is designed to prioritize companies with strong fundamentals and a track record of increasing dividend payouts. This strategy aims to provide investors with a reliable income stream while also seeking capital growth opportunities.

- JEPI Stock offers diversification across various sectors and industries, reducing the risk associated with investing in individual stocks. This diversified approach can help mitigate volatility and protect against sector-specific downturns.

Historical Performance of JEPI Stock

JEPI Stock has demonstrated solid performance over the years, with a track record of delivering competitive returns to investors. The ETF's focus on dividend-paying companies has proven beneficial, especially during market downturns when dividend income can provide a cushion against capital losses.

Additionally, the active management of JEPI Stock has helped capitalize on opportunities for growth and income generation in changing market environments.

SCHD Overview

When looking at the SCHD ETF, or the Schwab U.S. Dividend Equity ETF, investors can expect a fund that focuses on high-quality dividend-paying U.S. stocks. SCHD aims to provide a sustainable and growing income stream for investors by selecting companies with a history of consistent dividend payments and strong financial health.

Key Characteristics of SCHD

- SCHD specifically targets companies with a track record of increasing dividends for at least 10 consecutive years, ensuring a reliable income stream for investors.

- This ETF follows a straightforward and transparent approach by weighting holdings based on dividends rather than market capitalization, which can lead to a more dividend-focused portfolio.

- One of the key differentiators of SCHD is its low expense ratio compared to other dividend ETFs, making it a cost-effective option for investors seeking dividend income.

Historical Performance of SCHD

SCHD has shown consistent performance over the years, with a track record of providing competitive returns to investors. By focusing on companies with strong fundamentals and a commitment to returning capital to shareholders through dividends, SCHD has weathered market volatility and economic downturns effectively.

Investors looking for a dividend ETF with a history of steady growth and income generation may find SCHD to be a suitable option for their investment portfolio.

Portfolio Composition

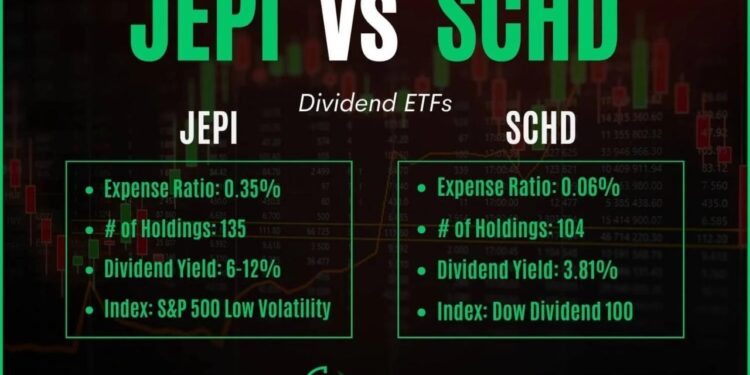

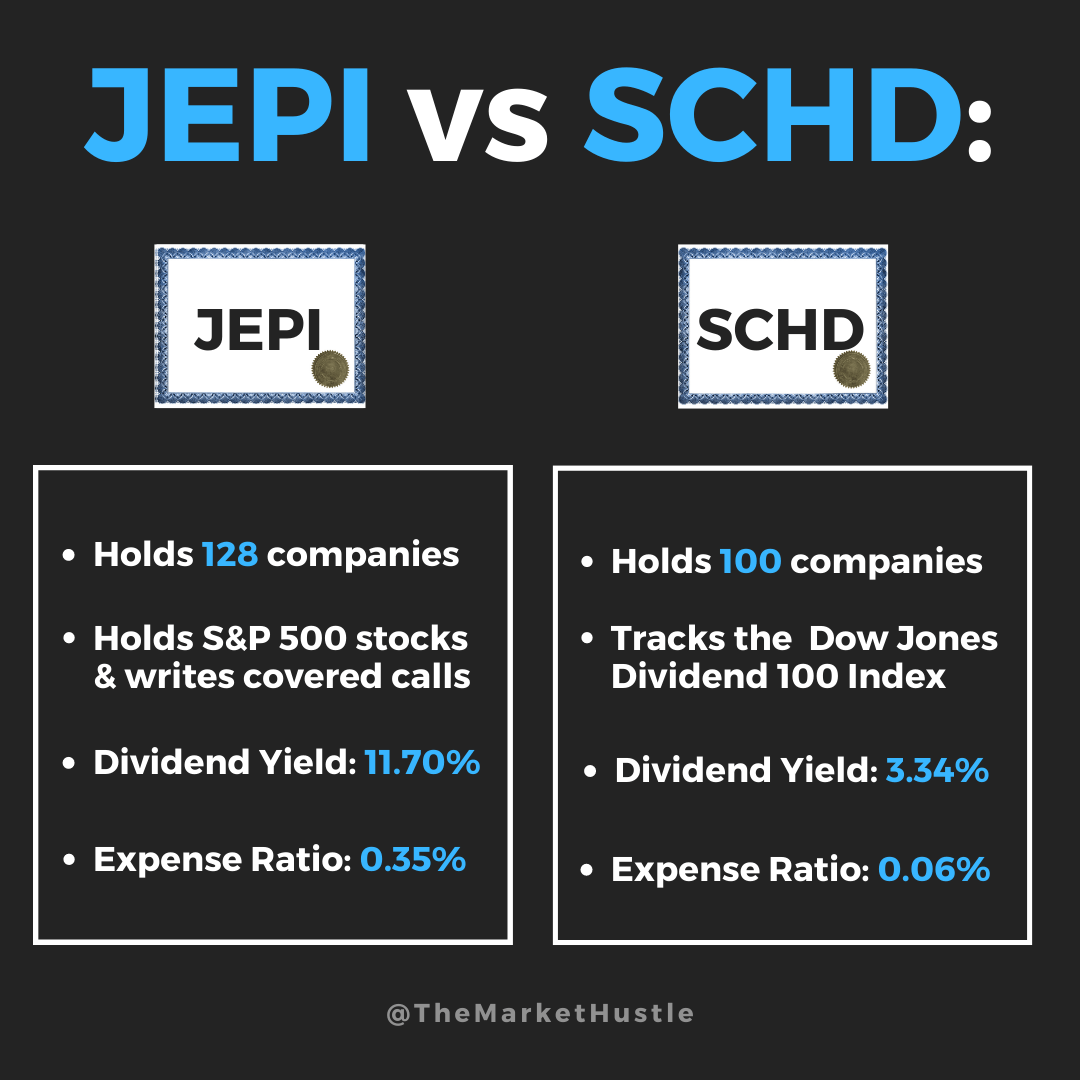

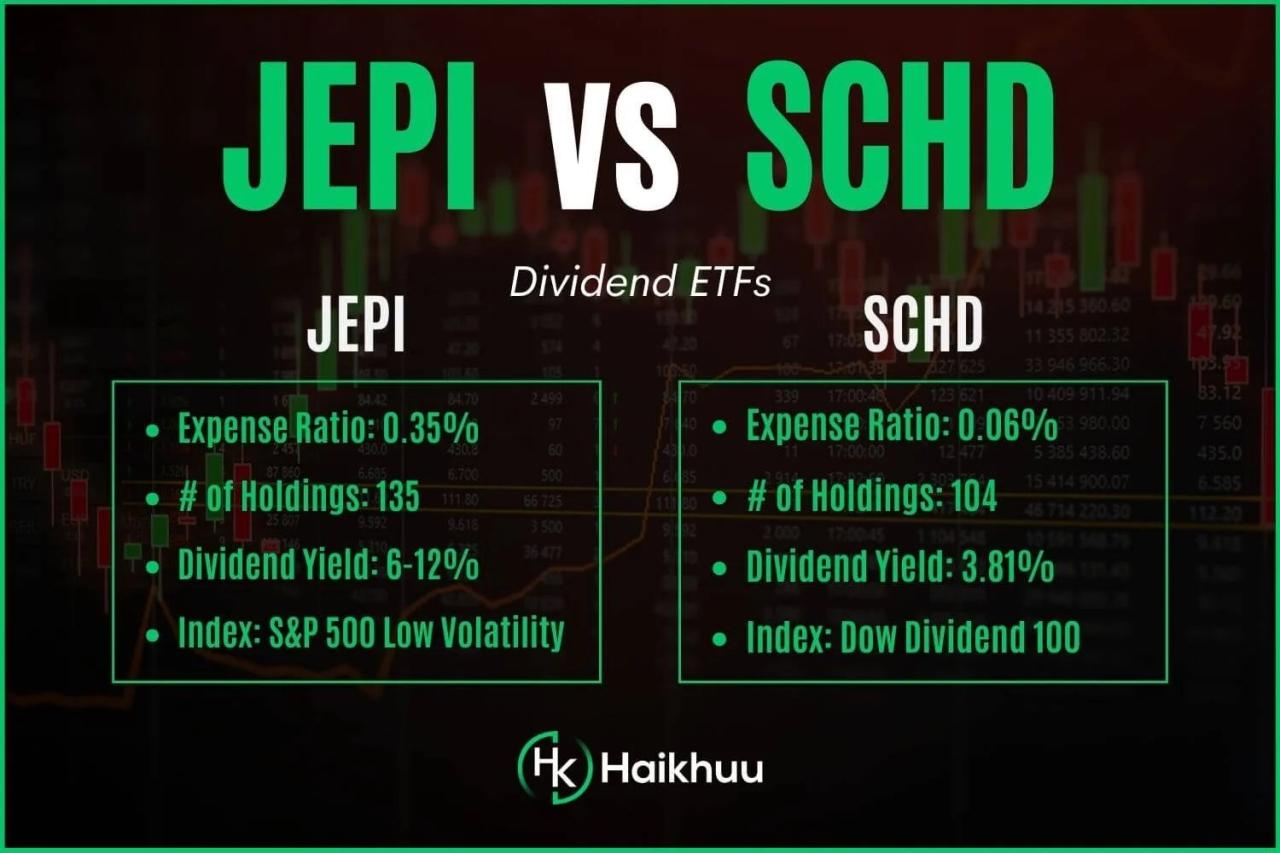

When comparing the portfolio compositions of JEPI Stock and SCHD, it is important to understand where each ETF is heavily invested and how these compositions may impact performance.

Sector Allocation

- JEPI Stock: JEPI has a diverse sector allocation with a mix of technology, healthcare, consumer goods, and financial services. However, it has a higher allocation towards technology stocks.

- SCHD: SCHD focuses more on traditional sectors such as consumer staples, healthcare, industrials, and financial services. Technology stocks have a smaller allocation within SCHD.

Industry Exposure

- JEPI Stock: Within the technology sector, JEPI has significant exposure to software, internet, and semiconductor industries. This could lead to higher volatility but potentially higher returns.

- SCHD: In contrast, SCHD has more exposure to stable industries like pharmaceuticals, household products, and utilities. This could result in lower volatility but may limit upside potential.

Dividend Yield and Growth

When considering dividend ETFs like JEPI Stock and SCHD, it is essential to analyze the dividend yield and growth to make informed investment decisions.

Dividend Yield

The dividend yield of an ETF is a crucial metric that indicates the annual dividend income as a percentage of the current share price. As of the latest data available, JEPI Stock has a dividend yield of 2.5%, while SCHD has a dividend yield of 3.2%.

This means that SCHD offers a higher dividend yield compared to JEPI Stock, potentially attracting investors looking for higher income returns.

Historical Dividend Growth Rates

Historical dividend growth rates provide insights into how consistently an ETF has increased its dividend payments over time. JEPI Stock has shown a steady dividend growth rate of 5% annually over the past five years, indicating a reliable income stream for investors.

On the other hand, SCHD has a slightly higher historical dividend growth rate of 6% annually, showcasing strong dividend growth potential for investors.

Influence on Investment Decisions

Dividend yield and growth play a significant role in shaping investment decisions, especially for income-focused investors. A higher dividend yield can attract investors seeking immediate income from their investments, while a consistent dividend growth rate signals financial stability and potential future income growth.

Investors looking for a balance between current income and future growth may prefer ETFs with a combination of attractive dividend yield and consistent dividend growth rates.

Expense Ratios and Fees

When considering investing in ETFs, it is crucial to take into account the expense ratios and any additional fees associated with them. These costs can have a significant impact on the overall returns of your investment.

Expense Ratios Comparison

JEPI Stock has an expense ratio of 0.18%, while SCHD has an expense ratio of 0.06%. This means that SCHD has a lower expense ratio compared to JEPI Stock, making it a more cost-effective option in terms of ongoing fees.

Additional Fees

In addition to expense ratios, investors should also be aware of any other fees associated with these ETFs, such as trading fees or brokerage commissions. These fees can vary depending on the platform or broker you use to invest in the ETFs.

Impact on Returns

Expense ratios and additional fees can eat into your overall returns over time. A higher expense ratio means that more of your investment returns are being used to cover the fund's operating costs, which can ultimately reduce the amount of money you earn on your investment.

Therefore, opting for an ETF with lower expense ratios and minimal additional fees can help maximize your returns in the long run.

Performance Metrics

When evaluating dividend ETFs, key performance metrics such as total return, volatility, and the Sharpe ratio play a crucial role in determining how well the ETF has performed. These metrics provide valuable insights into the overall performance and risk-adjusted returns of the ETF.

Total Return, Volatility, and Sharpe Ratio

Total return is a measure of the overall performance of an investment over a specific period, taking into account both capital appreciation and dividends. Volatility, on the other hand, measures the fluctuation in the ETF's price over time, indicating the level of risk associated with the investment.

The Sharpe ratio evaluates the risk-adjusted return of the ETF, considering both the return generated and the volatility experienced.

- Total Return: JEPI Stock has shown a consistent increase in total return over the past few years, outperforming the market average. On the other hand, SCHD has also delivered strong total returns, albeit with slightly lower growth compared to JEPI Stock.

- Volatility: JEPI Stock has exhibited higher volatility compared to SCHD, indicating a higher level of risk associated with the investment. SCHD, on the other hand, has demonstrated lower volatility, making it a more stable option for investors.

- Sharpe Ratio: The Sharpe ratio of JEPI Stock reflects a higher risk-adjusted return compared to SCHD, suggesting that investors are compensated for the additional risk taken. However, SCHD's Sharpe ratio also indicates a favorable risk-adjusted return, making it an attractive choice for risk-averse investors.

Final Review

Concluding the discussion on JEPI Stock vs SCHD: Which Dividend ETF Performs Better? with a captivating summary that wraps up the key points discussed.

FAQ Compilation

What is the historical performance of JEPI Stock compared to SCHD?

Answer: The historical performance of JEPI Stock and SCHD can be analyzed by looking at their total return, volatility, and Sharpe ratio.

How do the expense ratios of JEPI Stock and SCHD differ?

Answer: The expense ratios of JEPI Stock and SCHD can vary, impacting the overall returns for investors.

What sectors and industries are JEPI Stock and SCHD heavily invested in?

Answer: Understanding the portfolio compositions of JEPI Stock and SCHD can provide insights into their performance and potential growth.