Kicking off with JEPI Stock Dividend Explained: Why Investors Love This Monthly Payout, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Now, let's delve into the details of JEPI stock dividend and why it's a favorite among investors.

Introduction to JEPI Stock Dividend

JEPI stock dividend is a monthly payout provided by the JPMorgan Equity Premium Income ETF. This unique dividend structure has gained popularity among investors due to its consistent monthly payments and attractive yields.

Why Investors are Interested in JEPI Stock Dividend

Investors are drawn to JEPI stock dividend for its reliable monthly income stream, which can help supplement their regular earnings. The consistent payouts offer a sense of stability and predictability, making it an appealing option for income-focused investors.

How JEPI Stock Dividend Differs from Traditional Stock Dividends

- JEPI stock dividend is structured as a monthly payout, unlike traditional stock dividends that are typically distributed quarterly or annually.

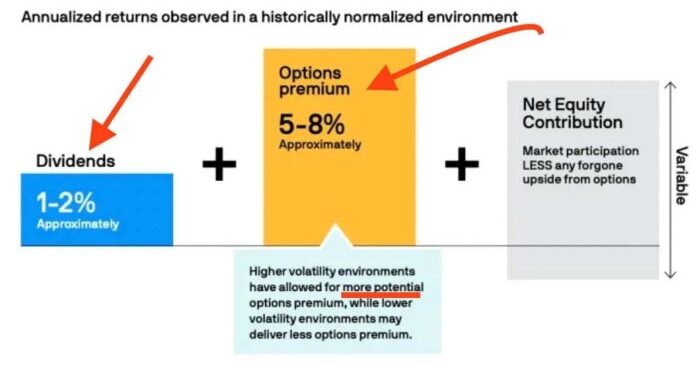

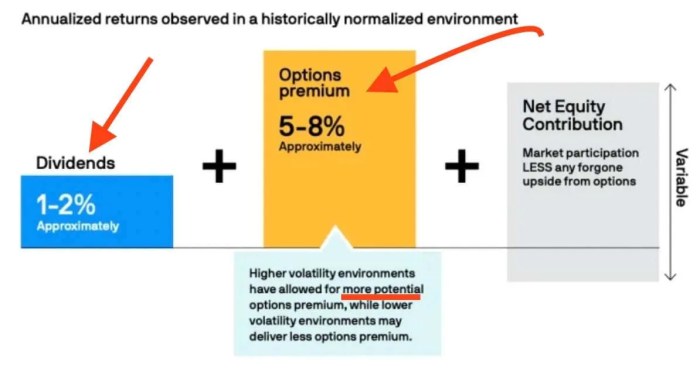

- Traditional stock dividends are usually tied to a company's performance, while JEPI stock dividend is based on the ETF's strategy and portfolio management.

- JEPI stock dividend provides investors with exposure to a diversified portfolio of equities, bonds, and other income-generating assets, offering a unique income opportunity compared to individual stock dividends.

Benefits of Monthly Payouts

Receiving monthly dividends can offer several advantages to investors compared to quarterly or annual payouts. The consistent flow of income can provide stability and help investors meet their financial goals more effectively.

Regular Cash Flow

- Monthly dividends ensure a steady stream of income, allowing investors to cover expenses or reinvest the funds promptly.

- This predictable cash flow can be particularly beneficial for retirees or individuals who rely on investment income for their living expenses.

Compounding Effect

- Monthly payouts can be reinvested more frequently compared to quarterly or annual dividends, leading to a compounding effect that can accelerate the growth of the investment portfolio over time.

- By reinvesting dividends on a monthly basis, investors can potentially maximize their returns through the power of compounding.

Flexibility and Liquidity

- Monthly dividend payments provide investors with greater flexibility and liquidity, as they have access to a portion of their investment returns on a more frequent basis.

- Investors can choose to reinvest the dividends, use the funds for other investment opportunities, or simply cash out as needed.

Understanding JEPI Stock

JEPI stock represents an exchange-traded fund (ETF) that focuses on providing investors with monthly dividend payouts. This ETF is designed to track the performance of high-dividend-paying stocks in the U.S. equity market.

Historical Performance of JEPI Stock

- Over the past few years, JEPI stock has demonstrated a consistent track record of delivering attractive dividend yields to investors. The monthly payouts have made it a popular choice among income-seeking investors looking for regular cash flow.

- Despite fluctuations in the market, JEPI stock has shown resilience and has maintained its dividend payouts, making it a reliable option for investors seeking stability in their investment portfolio.

- Investors who have held JEPI stock for the long term have benefited from the compounding effect of reinvesting the monthly dividends, leading to potential growth in their overall investment.

Factors Impacting JEPI Stock Price and Dividends

- Market Conditions: Fluctuations in the overall market can impact the price of JEPI stock. Economic indicators, interest rates, and geopolitical events can all influence the performance of the ETF.

- Company Performance: The financial health and performance of the companies included in the ETF can directly affect JEPI stock price and dividends. Strong earnings growth and dividend sustainability are key factors to consider.

- Interest Rates: Changes in interest rates can impact the attractiveness of dividend-paying stocks like those included in JEPI. Rising interest rates may lead investors to seek alternative investments, potentially affecting the demand for JEPI stock.

Risks Associated with JEPI Stock

Investing in JEPI stock comes with certain risks that investors should be aware of in order to make informed decisions. Understanding these risks can help investors navigate the market effectively and mitigate potential losses.

Potential Risks Involved in Investing in JEPI Stock

- Market Volatility: JEPI stock prices can be subject to significant fluctuations due to market conditions, economic factors, and investor sentiment. This volatility can impact the value of your investment.

- Interest Rate Risks: Changes in interest rates can affect the performance of JEPI stock, especially since it is a dividend-paying investment. Rising interest rates can lead to a decrease in stock prices.

- Company Performance: JEPI stock dividends are dependent on the financial health and performance of the underlying companies in the ETF. Poor performance by these companies can result in lower dividends.

How Market Conditions Can Affect JEPI Stock Dividends

- Interest Rate Environment: JEPI stock dividends can be impacted by changes in interest rates set by the Federal Reserve. Higher interest rates can lead to lower stock prices and reduced dividend payouts.

- Economic Indicators: Economic factors such as GDP growth, inflation rates, and unemployment levels can influence the overall market conditions, which in turn affect JEPI stock dividends.

Strategies Investors Can Use to Mitigate Risks when Investing in JEPI Stock

- Diversification: By diversifying your investment portfolio across different asset classes and sectors, you can reduce the impact of any single stock's performance on your overall returns.

- Regular Monitoring: Stay informed about market trends, company news, and economic developments that could impact JEPI stock prices and dividends. Regular monitoring can help you make timely decisions.

- Long-Term Perspective: Consider investing in JEPI stock with a long-term perspective to ride out short-term fluctuations and benefit from the compounding effect of reinvested dividends over time.

Closing Summary

In conclusion, JEPI stock dividend offers a unique opportunity for investors seeking regular monthly payouts, making it a lucrative option in the market.

General Inquiries

What is JEPI stock dividend?

JEPI stock dividend refers to the regular payments made to shareholders from the company's earnings.

How does JEPI stock dividend differ from traditional stock dividends?

JEPI stock dividend stands out by offering monthly payouts compared to the usual quarterly or annual dividends.

What are the benefits of receiving monthly dividends?

Monthly dividends provide investors with a consistent income stream and enable them to reinvest more frequently.

What factors may impact JEPI stock price and dividends?

Market conditions, company performance, and economic trends can influence JEPI stock price and dividend payments.

How can investors mitigate risks associated with JEPI stock?

Investors can diversify their portfolio, stay informed about market changes, and set stop-loss orders to manage risks when investing in JEPI stock.