As Financial Issues in Marriage: 7 Money Habits That Destroy Relationships takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Financial problems can significantly impact relationships, leading to conflicts and even divorce. Understanding the key money habits that can harm marriages is crucial for maintaining a healthy financial life together.

Introduction to Financial Issues in Marriage

Money habits have a significant impact on relationships, especially in marriages. The way a couple manages their finances can either strengthen their bond or become a source of conflict.

Financial problems often lead to marital conflicts due to differences in spending habits, financial goals, and communication breakdowns. Issues such as debt, lack of transparency, and unequal financial contributions can strain a relationship.

Correlation Between Money and Divorce

Studies have shown a clear correlation between money and divorce rates. Financial stress is a leading cause of marital breakdown, with disagreements over money matters being a significant predictor of divorce.

Lack of Communication about Finances

Open communication about finances is crucial in a marriage to ensure both partners are on the same page and working towards common financial goals. When there is a lack of communication, misunderstandings can arise, leading to financial issues that can strain the relationship.

Examples of Poor Communication Leading to Financial Issues

- One partner making significant financial decisions without consulting the other, leading to resentment and mistrust.

- Not discussing financial priorities and goals, resulting in conflicting spending habits and budgeting issues.

- Hiding debts or financial struggles from each other, causing stress and anxiety when the truth is revealed.

Strategies for Improving Communication Regarding Finances

- Schedule regular money meetings to openly discuss financial matters, including budgeting, savings goals, and any concerns.

- Be transparent about individual spending habits and financial obligations to avoid surprises or conflicts.

- Create a shared financial plan that Artikels short-term and long-term goals, as well as how each partner will contribute.

- Seek the help of a financial counselor or advisor to facilitate discussions and provide expert guidance on managing finances as a couple.

Different Financial Goals and Values

When partners in a marriage have conflicting money goals, it can put a significant strain on their relationship. These differences can lead to arguments, resentment, and ultimately affect the stability of the marriage.

Impact of Differing Values on Spending and Saving Habits

Having different values when it comes to finances can greatly impact how a couple manages their money. For example, one partner may value security and prioritize saving for the future, while the other may prioritize enjoying the present moment and spending money on experiences.

This misalignment can lead to disagreements on how money should be spent, saved, or invested. It can also create tension around financial decisions, as each partner may feel that their values are not being respected or considered.

Tips for Aligning Financial Goals and Values within a Relationship

- Have open and honest discussions about your financial goals and values. Take the time to understand where each partner is coming from and why certain financial priorities are important to them.

- Create a joint budget that reflects both partners' values and priorities. This can help ensure that both partners feel heard and respected in the financial decision-making process.

- Compromise when necessary. It's important to find a middle ground that allows both partners to feel satisfied with their financial choices. This may involve making trade-offs or adjustments to accommodate each other's values.

- Seek professional help if needed. If couples find it challenging to align their financial goals and values on their own, they may benefit from the guidance of a financial advisor or counselor who can provide strategies for better communication and decision-making.

Hiding Financial Information

Financial transparency is crucial in a marriage as it builds trust and fosters open communication. When one partner decides to hide financial details from the other, it can lead to various negative consequences that can severely impact the relationship.One of the main consequences of hiding financial information is the erosion of trust between partners.

Trust is the foundation of any successful marriage, and when one partner chooses to keep financial secrets, it can create a sense of betrayal and deceit. This can lead to feelings of resentment, anger, and ultimately, a breakdown in the relationship.Financial secrecy can also lead to misunderstandings and conflicts within the marriage.

For example, if one partner is secretly accumulating debt or making large financial decisions without consulting the other, it can create tension and arguments when the truth eventually comes to light. This can result in a breakdown of communication and a lack of alignment in financial goals.To promote transparency in financial matters, couples should prioritize open and honest communication about money.

This includes discussing financial goals, budgeting together, and being transparent about income, expenses, and debts. Setting regular financial check-ins can also help ensure that both partners are on the same page and can address any concerns or issues before they escalate.

Strategies for Promoting Financial Transparency

- Schedule regular money talks to discuss financial goals, budgets, and any concerns.

- Be open about income, expenses, debts, and financial decisions.

- Consider using joint accounts for shared expenses to promote transparency.

- Seek the help of a financial advisor or counselor to facilitate discussions and establish healthy financial habits.

- Work together to create a financial plan that aligns with both partners' goals and values.

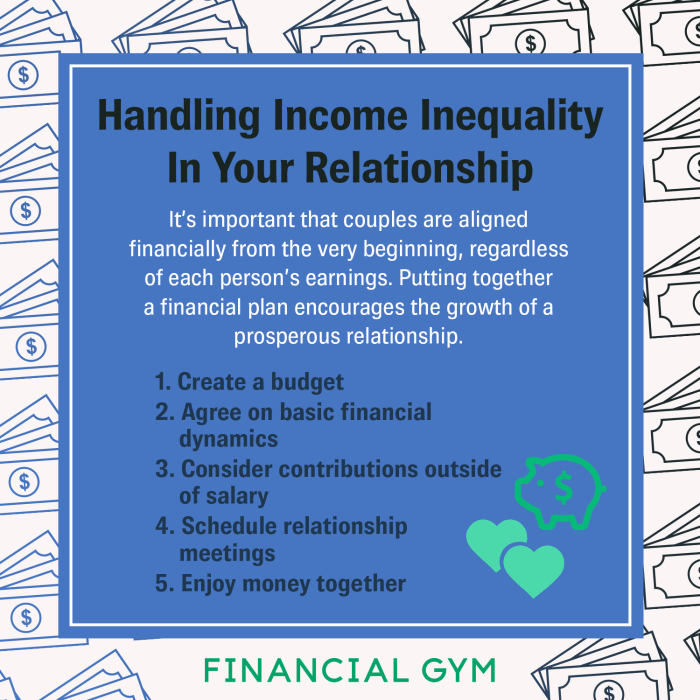

Unequal Financial Contributions

Financial contributions in a marriage play a crucial role in maintaining harmony and trust within the relationship. When one partner consistently contributes more financially than the other, it can lead to feelings of resentment, inequality, and strain on the relationship.

The Importance of Fair Financial Distribution

Unequal financial contributions can create a power dynamic imbalance in a marriage, where one partner may feel undervalued or dependent on the other. This imbalance can lead to conflicts, misunderstandings, and a lack of financial transparency, ultimately eroding the foundation of the relationship.

It is essential for couples to have open and honest discussions about their financial contributions to ensure fairness and equality in the relationship.

Addressing and Balancing Financial Responsibilities

To address unequal financial contributions, couples should consider pooling their financial resources or creating a joint account for shared expenses. This approach can help foster a sense of partnership and shared responsibility in managing finances. Additionally, setting clear financial goals together and creating a budget that reflects both partners' contributions can help balance financial responsibilities and avoid resentment.

- Regularly communicate about financial expectations and contributions.

- Work together to create a budget that reflects both partners' financial goals and values.

- Consider seeking the help of a financial advisor to navigate complex financial situations and ensure fair distribution of resources.

- Reassess financial arrangements periodically to adjust for any changes in income or expenses.

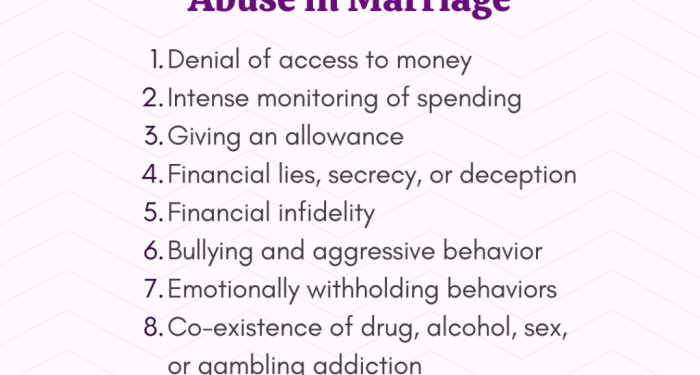

Financial Infidelity

Financial infidelity refers to the act of hiding financial information, lying about money matters, or making financial decisions without your partner's knowledge. This breach of trust can have a significant impact on marital relationships, leading to feelings of betrayal, resentment, and lack of transparency.

Examples of Financial Infidelity Behaviors

- Opening secret bank accounts or credit cards

- Making major purchases without consulting your partner

- Lying about income or debts

- Spending money on hidden vices or addictions

- Hiding financial windfalls or bonuses

Strategies for Rebuilding Trust After Financial Betrayal

- Open and honest communication about finances

- Seeking professional help or counseling to address underlying issues

- Creating a joint budget and financial goals

- Regularly reviewing and discussing financial statements together

- Building transparency and accountability in financial matters

Failure to Budget and Plan for the Future

Budgeting and planning for the future are crucial aspects of managing finances in a marriage. When couples fail to budget or save for the future, it can lead to a variety of negative consequences that may strain the relationship.

Consequences of Not Budgeting or Saving

- Increased financial stress and arguments over money matters.

- Lack of financial security and preparedness for emergencies or unexpected expenses.

- Inability to achieve long-term financial goals such as buying a house, saving for retirement, or funding children's education.

Importance of Financial Planning

- Financial planning helps couples align their goals and priorities, fostering a sense of unity and shared responsibility.

- It provides a roadmap for achieving financial milestones and ensures that resources are allocated efficiently.

- Planning for the future promotes stability, security, and peace of mind within the relationship.

Practical Tips for Creating a Budget and Financial Plan

- Start by establishing clear financial goals and priorities as a couple.

- Track your income and expenses to understand your spending habits and identify areas where you can cut back.

- Create a detailed budget that Artikels how much money will go towards essentials, savings, and discretionary spending.

- Regularly review and adjust your budget to accommodate changes in income or expenses.

- Consider seeking professional help or using financial planning tools to streamline the process and stay on track.

Closure

In conclusion, navigating financial issues in marriage requires open communication, shared goals, transparency, and planning for the future. By addressing these money habits that can destroy relationships, couples can strengthen their bond and secure their financial future together.

Answers to Common Questions

What are some tips for aligning financial goals in a relationship?

One effective way is to have regular discussions about financial goals, understand each other's perspectives, and work towards a common vision for the future.

How can couples address unequal financial contributions?

Couples can consider creating a joint account for shared expenses, discussing a fair distribution of financial responsibilities, and being open about their individual financial situations.

What steps can be taken to rebuild trust after financial infidelity?

Rebuilding trust involves honest conversations, setting financial boundaries, seeking counseling if needed, and committing to full transparency moving forward.